AGENDA 2022

Understandably, the retailer and the brands are exploring new ways to know their customer more intimately. Buying / Sourcing / Merchandising / Designing teams with the retailers and brands, run by enterprising managers are critical links to the entire process of selecting the right design, right product and right vendor who can connect with the needs of the end customer.

RETAIL TODAY: Retail Drivers and Disruptors

SPEAKERS

METAVERSE, NFT, WEB 3.0, CRYPTO: Next Digital Frontiers in Fashion

SPEAKERS

MITIGATING RISKS IN SOURCING

Fundamental changes in consumer behavior are setting Business Leaders in motion to source closer to home on a need and demand basis, use alternate supply bases and products or reevaluate the suppliers. Supply chain leaders are trying to turn the complexity and disruption into meaningful change. Brands also have goals on sustainability which get passed to the T1 and T2 suppliers which adds to the cost of supply.

Why- As businesses respond to the immediate impacts of the pandemic and geopolitical issues, companies must develop a robust framework that includes a responsive and resilient contingency plan for the short as well as the longerterm period.

Read MoreSPEAKERS

Session Sponsor By

COMPLEMENT AND COLLABORATE - SYNERGIES BETWEEN INDIA AND BANGLADESH

Why- India has always had a large Cotton value chain and is now gaining critical headway in laying out the synthetic value chain and this can assist both India and Bangladesh with diminishing reliance on the Far East and China in fostering an enormous amount of synthetic fabric and pieces of clothing. Also, India and Bangladesh are similar nations and with similar values and aspirations. Proximity should also lead to increased investments from both countries into each other. Govt. of both the countries can achieve mutual benefits through it and this would strengthen the bond between the two.

Read MoreSPEAKERS

Session Sponsor By

D2C OPPORTUNITIES FOR FASHION

Why- As the Indian fashion market is witnessing an uptick in consumption, the brands have a bigger opportunity to reach consumers through the D2C model. The D2C model also brings order to the otherwise unorganized fashion sector hence increasing the revenues for brands.

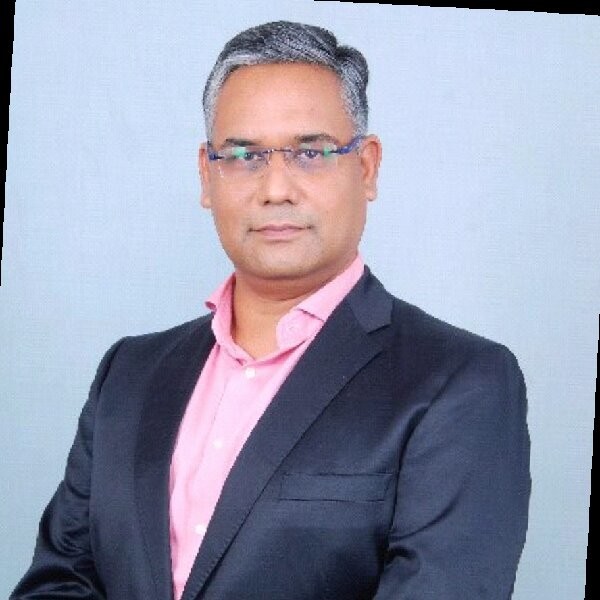

Read MoreSPEAKERS

IDEATIVE SESSION 1: TOPIC - FUTURE CONSUMER 2024 BY WGSN EXPERTS

SPEAKERS

Session Sponsor By

SPOTLIGHT SESSION 2: MR. MOHD. KAMALUDDIN, BGMEA

Bangladesh also needs to look at adding categories, looking at a higher value addition in garments, expanding to man made fiber-based products while keeping up the efforts on sustainability and productivity improvement and at the base level on the infrastructure development. How prepared is Bangladesh to meet the projected growth numbers? What does the country need to do differently for the next stage of growth?

The session sheds light on the challenges and opportunities in the domain. The renowned speaker from BGMEA will address the key endeavors being planned to ensure a sustainable long term growth of the Industry in Bangladesh.

Read More.png)